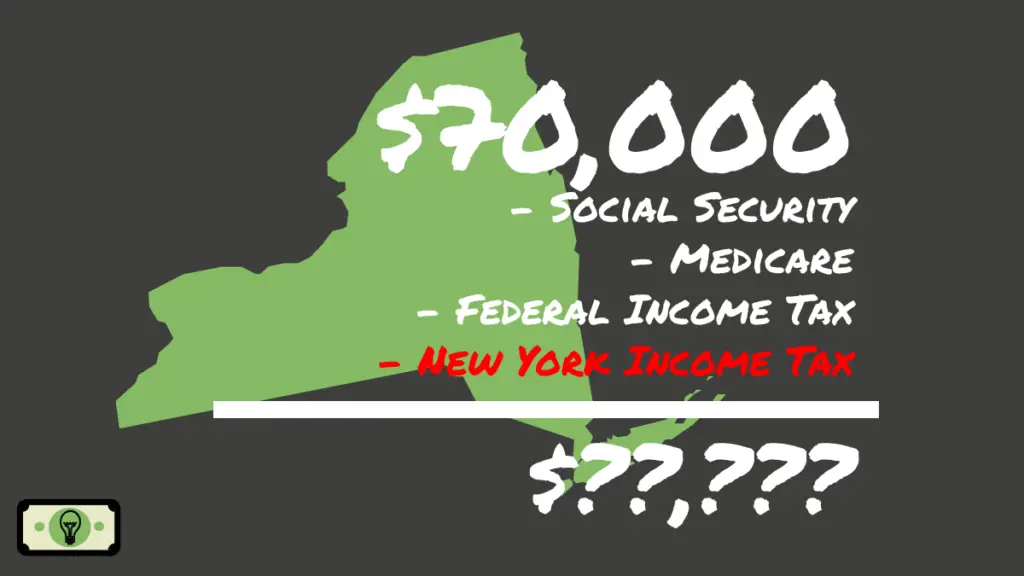

How much is $70,000 after taxes in New York State (single) [2023]

Income taxation reduces your $70,000 salary to $53,571.49 in New York State. Your employer withholds…

70K Dollars Salary After Taxes in Nevada (single) [2023]?

United States federal income taxation reduces your $70,000 salary to $56,985 take-home pay in Nevada….

70K Dollars Annually After Taxes in Alaska (single) [2023]?

United States federal income taxation reduces your $70,000 salary to $56,985 take-home pay in Alaska.Alaska…

70,000 Dollars Salary After Taxes in Florida (single) [2023]?

United States federal income taxation reduces your $70,000 salary to $56,985 take-home pay in Florida….

$70K Salary After Taxes in Texas (single) [2013]?

United States federal income taxation reduces your $70,000 salary to $56,985 take-home pay in Texas….

$70K Salary After Taxes in California (single) [2023]?

Income taxation reduces your $70,000 salary to $53,523.84 in California. Your employer withholds $16,476.16 in…

What are valuable budgeting skills for students?

What are valuable budgeting skills for students? Earning a college degree requires two connected budgets….

7 Important college expenses you need to budget for

A college education is not for the faint of heart. The sticker price of a…

When you need a household budget

A household has expenses that need to be funded by its members jointly. Creating a…

Importance of a personal budget for a happy financial life

A personal budget is essential to control your money and not let your money control…

Why budgeting is essential for students?

Budgeting is an essential skill to achieve your academic and financial goals. Academically, you want…

Importance of budgeting to your wealth

Budgeting for anything fosters planning and accountability with money. The importance of budgeting is to…

How to calculate your annual income from hourly wage

Try our New Wage to Salary Calculator Enter your hourly wage and how many hours…