Last week a reader asked me what I think about the 50/30/20 budget rule? I asked back, why she was interested and she told me that her godmother uses the 50/30/20 rule, but she was afraid to follow her example because it seems quite complicated.

Definition and history of the 50/30/20 budget rule

The 50/30/20 plan was made popular in the book “All Your Worth: The Ultimate Lifetime Money Plan“, written by Senator Elisabeth Warren and her daughter.

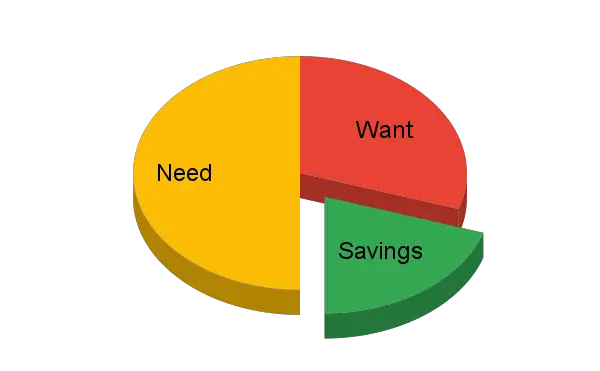

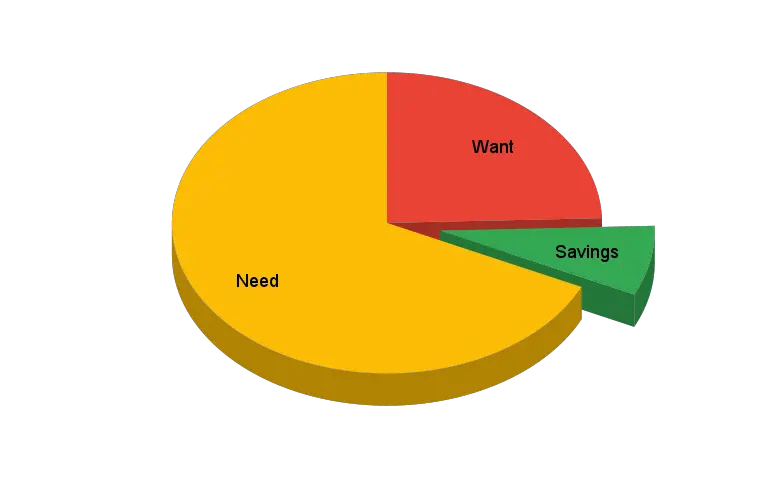

The rule says you should divide your after-tax income into the following spending groups. 50% of your income should go towards what you need. 30% of spending can be on things you want and 20% of your net income should go towards long-term savings or debt reductions.

The goal of this budget allocation is to ensure financial stability and to achieve long-term savings goals, such as a comfortable retirement. This is all achieved while leaving some money for enjoying life here and now.

Spend 50% on what you need

The rule suggests spending 50% of your net income on the kinds of things you can not survive without. The basic needs of every family are housing, clothing, and food. You can not survive without these.

To satisfy your housing needs, you need to pay the rent or the mortgage and taxes for your home. You further need to keep the home warm and fed with utilities such as power and water.

No one can go without food for long. You need to eat some basic food. These are the basic groceries that keep you fed and healthy. And count on food that keeps you healthy, not just cheap junk food. Further, you need basic household supplies, like soap, toothpaste, dishwashing soap, and detergents. The rule encourages you to count separately any food that is a luxury to have, such as organic food, sushi, or the popular groceries delivery cost. These go into the want section of your budget. You can include basic body care items, but not beauty creams.

We all need clothes to keep us protected from the elements. These are required expenses and belong to this part of your budget. This does not include the more expensive branded items or fur coats.

There may be other things that you need to have, such as the transportation to work, whether it is a car, its repairs, and the gas to keep it going, or a monthly pass for public transport. This can also include the suit, that you are required to wear in the office.

It is fine to make a rough calculation first, such as allocating all grocery bills in this section. You can think about the separation in more detail when you are substantially over the 50% threshold. It’s better to start with the allocation than to procrastinate your budgeting process.

Spend 30% on what you want

We all desire to spend money on ourselves or our family. Vacation travel is at the top of the list for most people. Also, trendier clothes, fancier food, faster cars, or bigger homes can seemingly make people happy. All these expenses go to the “want” section of the budget.

The recommendation of this plan is to keep your spending for things you want at or below 30%.

As mentioned above any upgrade of needs that are above the level of basic is to be counted here. This includes club memberships, entertainment and entertainment subscriptions, such as Hulu, Netflix, or Disney Plus. Further, consider any car expenses above the need to drive to work as a want to spend line item. Also, luxuries like designer clothes and accessories, watches, jewelry, and shoes go into this bucket. To simplify the accounting you can estimate a percentage of such expenses that cover the basic needs and allocate it there. The rest goes into this bucket.

Dining out is also something we want, but not a basic necessity. Fast food and, the morning coffee, and the treat from the bakery belong to this kind of spending as well.

Do not forget the hobbies you want to do and what expenses they cause. One of the luxuries that can become most costly is collecting anything of value.

Sadly even your generosity in form of charitable giving falls into this category.

Save 20% for the long-term

We all live in the here and now and want to enjoy the moment. However, we also can think ahead and we know there will be a time where we can’t have an income from holding down a job.

Saving 20% of your net income is a good rule of thumb calculation to prepare for a secure retirement. This assumes you start early in life and invest your long-term savings. This investment needs to pay you a substantial return on investment to benefit from the compounding interest effect. How to invest your money to achieve a return on investment needs to be covered separately.

If you have debt you should pay it down before investing money. Remember we are not talking about a mortgage, that we already took care of as a needed expense because it substitutes for rent payment.

You should pay down debt if the interest is equal to or higher than any return on investment you can achieve. While you should pay down debt, it is not actually savings. So if you have debt like student debt or car loans, and especially high-interest credit card debt, you should also lower your want spending until you have paid for the want spending you already did in the past.

Is the 50/30/20 budget rule good for you?

The goal of the 50/30/20 budgeting rule is to be financially stable and to save for long-term financial needs.

Just imagine what difference it makes in financial stability if your absolute essential spending is just 50% of your after-tax income. Presume you lose your job and primary source of income. Then your emergency fund of 3 mo income will not be exhausted in 3 months, but last 6 months. Of course, you must be able to eliminate the wanted expenses in these 6 months and stop put aside the savings. This gives you 6 months to find a new job, or to change even the must-have expenses. If you receive unemployment benefits, this time stretches out even longer.

The even greater benefit is that you are saving 20% of your income for retirement. If you are saving 20% of your after-tax income you’ll likely become a millionaire by the time your retire. How does that perspective sound to you? How does it make you feel thinking about such a retirement, where you don’t worry about how to get by? It requires some financial discipline to arrange your life within these boundaries. You don’t have to do it every month, not even every year. But if you start early and do it in 9 out of ten years or 11 out of 12 months, then you will live w/o daily financial worries.

Implementing Elizabeth Warren’s budget plan

So far so good. We only talked about the ideal allocations of 50% need spending, 30% want spending, and 20% savings. Let’s discuss what it takes to get from where you are to where you want to be.

Include the 50/30/20 rule in your budget spreadsheet

The first step is to have a budget and track it for current spending. You can use the zero-based budget as a starting point. You may have to refine this budget so, that you can separate the “must-have” and the “want-have” levels of expenses in the budget.

We recommend you do a first calculation allocating expenses roughly to the sections. For example call all grocery bills a “must-have”, although you do buy more of the fancier items. In turn, you allocate all clothes bills to the section of “want-have” expenses. This keeps your effort down and may be sufficient for you to have an overview of your spending. Keeping the budgeting effort reasonable is important because you will stick with it longer and make it a habit.

Finally, you need to have the sums of the three groups and calculate the percentage of your income. Then you compare your percentages to the 50/30/20 budget rule. Now you know where you stand.

What to do if my budget is off with the 50/30/20 rule?

If your budget is not close to the ideal rule, then you want to change things around to get closer to the target division in your spending.

If your savings is not even close to 20%, then you have to find ways to bring that up. The quickest way to achieve this goal is usually the reduction of want-expenses. Maybe, you do not go on that expensive cruise this year. Further, you can re-consider the various memberships and subscriptions. Are they really worth sacrificing your financial future?

A somewhat radical way of reducing your expenses is to “pay yourself first”, by automating the savings into an investment account and only spend the rest on the things you want to have. That way you realize the dwindling bank account balance and it reminds you to stop spending on luxury items when saving for retirement is more important to you.

In our example, the Need spending is way over 50%. Usually, this is a bit harder to reduce. First, you want to examine, if this spending is really needed. If you find portions that are actually expenses you want but don’t need, you can re-allocate them. Then look at your want spending just as before.

You can also seek additional income, like asking for a raise or looking for higher-paying employment. If the overall pie grows, then the extra income can go towards the savings and align the budget with the 50/30/20 allocation rule.

Whatever you do, if you have a stable income, you can take a little time to adjust things gradually. Let’s say you can adjust things in 12 months. If you face a crisis in spending or income, you better act as fast as possible.

The bottom line

Too many Americans live paycheck to paycheck. The personal savings rate pre COVID-19 pandemic was 7 – 7.5%, down from 11% in 1960. At the same time, Americans spend on average between 9.5% and 10% of their disposable income servicing debt. Most experts agree this is not a financially stable situation and they warn, many households will have to cut back their lifestyle in retirement.

Senator Warren proposes a reasonable rule to gain financial stability in the short term and the long term. If you follow it, you will cut back on your lifestyle a little now, but you win peace of mind, that you are prepared for emergencies and that you can sustain this lifestyle when you retire from work.

Further Reading

You may also like to read how you can minimize your efforts to keeping your personal budget in a spreadsheet. If you prefer a printable template for your personal budget we have you covered.

You won’t need to track 100 budget categories, but a few will do.